You've most probably seen a flight review on Youtube or on the web (Maybe even our website), and when it comes to the question of how the reviewer could afford the business class flights here and there, it almost always comes with the same answer - Airline miles. So how do they rack up such a huge amount of miles?

Disclaimer: This article is NOT sponsored by any company. All opinions/examples are my own.

By: Haotian

Published on: 22 December 2023, 9.00pm (GMT +8)

Paying $5.00 for a ticket, alongside 60,000 miles, isn't as crazy as it sounds. Photo: Haotian (@plane.tian)

Choosing the right Credit Cards matter

Firstly, credit cards do in fact matter. If you are really passionate about "mile chasing", which simply means accumulating miles, you would probably like to go for a card that earns you miles for every purchase. Some cards even come with a sign up bonus of a certain amount of miles, as long as you pay the annual fee of the card, which varies from just under a hundred, to a few hundred dollars. One example of a credit card which is linked to my Krisflyer account is the Krisflyer AMEX Ascend Credit Card.

The Krisflyer AMEX Ascend Card. Photo: American Express (americanexpress.com)

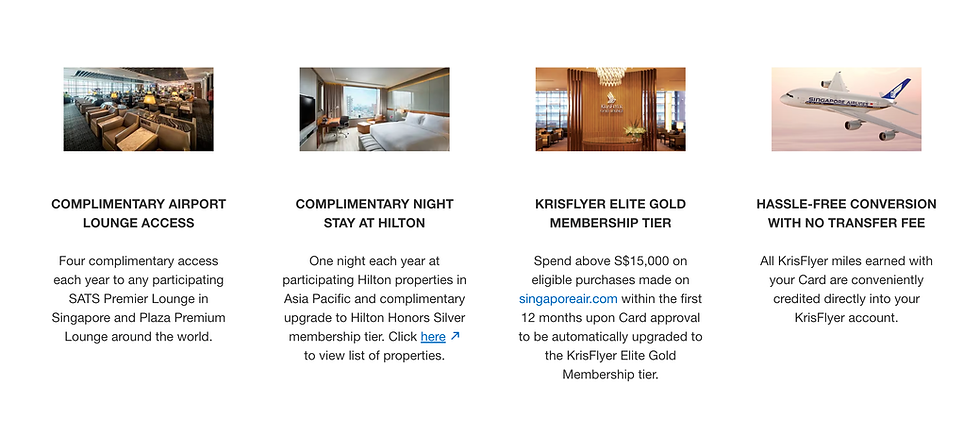

The card has an annual fee of about $340, but this amount is "reimbursed" in other forms, such as annual lounge passes, fast track to Krisflyer Gold Elite, a complimentary stay in a hotel, just to name a few.

The card comes with quite a few benefits. Photo: American Express (americanexpress.com)

Now, time for the main event - the miles.

When I signed up for this card in 2022, there was a sign up bonus of 15,000 Krisflyer miles. Quite a small amount, you may think. However, once the first payment on the card goes through, you would earn an additional 5,000 Krisflyer miles. And I am not sure about the sign up bonus in 2023, but it seems that you are still able to earn quite an amount of miles, by spending $3,000 in one year.

The perks of signing up for this card in 2023. Photo: American Express (americanexpress.com)

Well, you may think 20,000 miles isn't really a lot. Well - you're probably right. But not to worry - You can earn it from other means, just by spending.

Want to purchase a $3000 camera? Congratulations, you have just earned 3,600 miles. A pro tip is to pay for your house renovations with the card - Thank me later. A flight to Europe in Premium Economy paid by cash would earn you approximately 7,000 miles.

There's many different ways to earn miles from the card. Photo: American Express (americanexpress.com)

Of course, there are definitely plenty of different cards out there that earn you miles, not just this specific card - This is just an example. There are cards that earn you miles on Oneworld carriers, Skyteam carriers, et cetera. Just go with whatever floats your boat! And don't forget to check their sign up bonuses.

Choose a hotel brand that you prefer

Marriott offers points transfer to 39 airlines. Photo: Marriott (marriott.com)

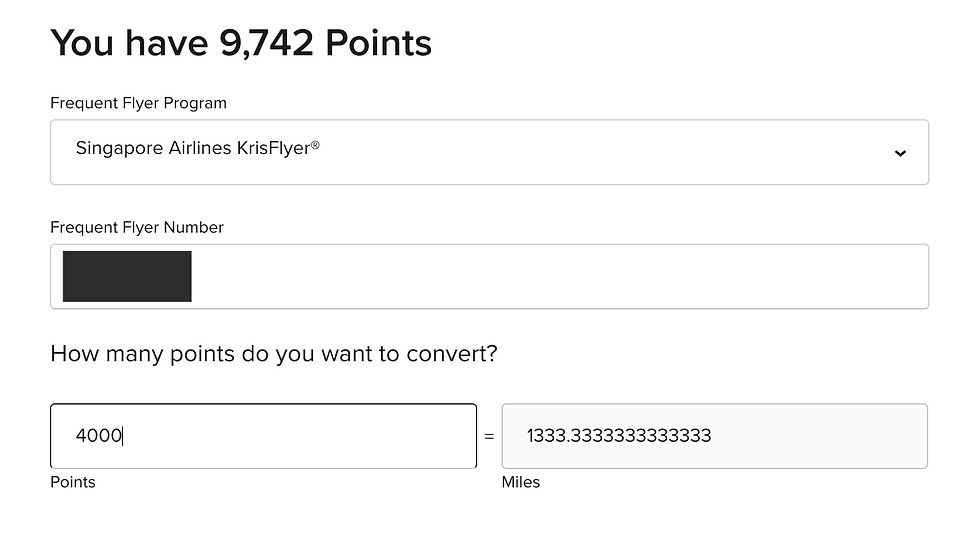

Marriott Bonvoy, World of Hyatt, ALL Accor, IHG Rewards - You have probably heard of at least one of these brands. Yep, the "Big Four" hotel chains. Each of them have their own loyalty programs. When you sign up with them to be a member, and book a stay, you earn hotel points. These points can be converted to airline miles. For example, I am a Marriott Bonvoy member, so I frequently stay at their properties. For Marriott Bonvoy hotels, 1 US Dollar spent is equivelant to 10 points earned. Then, the points earned can be transferred to your choice of airline frequent flyer programs. For example, most airlines that Marriott Bonvoy currently allows transfers to has a transfer ratio of 3:1, where every 3 Marriott Bonvoy points earn you 1 airline mile.

For example, the hotel you are staying at costs $400 USD a night. This would mean you have earnt 4000 Marriott Bonvoy points. Then, if you would like to transfer these points to Singapore Airlines Krisflyer, you would be receiving 1334 Krisflyer miles - just an example.

Marriott Bonvoy offers points transfer to most airlines based on a 3:1 ratio. Photo: Marriott (marriott.com)

Of course, this is again depending on the hotel chain you prefer. Remember to check with their website to see the transfer ratio, as well as their point-earning system.

Join the airline's frequent flyer program

Probably the most well-known and hassle free way is to simply sign up for a frequent flyer membership with the airline you fly the most. Not to worry though, if you are enrolled in a frequent flyer program in KLM, but you would like to use your points in Air France's Flying Blue, you can normally do transfers with a 1:1 ratio - as long as the airlines are in the same alliance, which, in this case, is Skyteam. If you find that too annoying, you can also book an Air France ticket on KLM's website most of the time, though the redemption rate could be much worse.

This is not really the most feasible idea, as the miles earnt are, more often than not, very meagre. For example, on a flight operated by Singapore Airlines from Singapore to Hong Kong in economy class, would only earn you about 800 miles per way, which is really not that much. This is why most people book a more expensive flight ticket to earn more miles. For example, in business class, you are able to earn close to 2,000 miles per way - a stark contrast to 800 miles. However, this is still not a really feasible idea if you like doing mile-chasing.

Redeeming the miles

Now comes probably the most important part - Redeeming the miles you have accumulated. The technique is to find saver tickets, which is the cheapest redemption option. However, saver tickets are not always available, and when that is the case, you would have to make to with advantage tickets, which is more expensive to redeem, but almost always available. For example, on Singapore Airlines and Star Alliance carriers, a saver ticket to Bangkok in business costs 24,000 miles per way plus tax, while an advantage ticket to Bangkok in business costs 40,000 miles per way plus tax.

The rates of saver tickets versus advangtage tickets. Photo: Singapore Airlines (singaporeair.com)

However, for Singapore Airlines and some other airlines, there would be promotional tickets sometimes - these tickets usually go at a 30% discount. For example, on Singapore Airlines, it is known as Spontaneous Escapes, and promo tickets to Bangkok can cost only about 16,800 miles. The downside, however, is that the list for the discounts only come out half a month prior, so it is not always guaranteed a discounted fare is available. If you would like to check it out, you can go to: https://www.singaporeair.com/en_UK/sg/plan-travel/promotions/global/kf/kf-promo/kfescapes/ (Do note that this is not an affiliated link, and I am simply giving an example.)

This is just a guide to using miles to book your next flight. Do understand that this does not mean that miles is a better way to book tickets, just that some people prefer to do it this way.

Conclusion

When people say they only paid $5.00 for their ticket, they refer to the mandatory airport taxes they paid, and not the flight ticket, which they paid in miles. Mile-chasing is a rather foreign phrase to some people, but it really isn't that complicated once you get the hang of it.

With that, this sums up this rather unusual article for this Friday. Do check our website every Friday for the newest release!

Comments